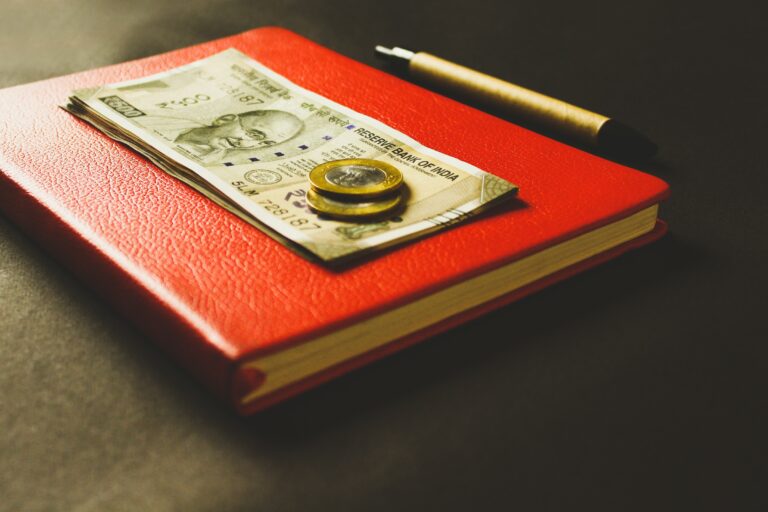

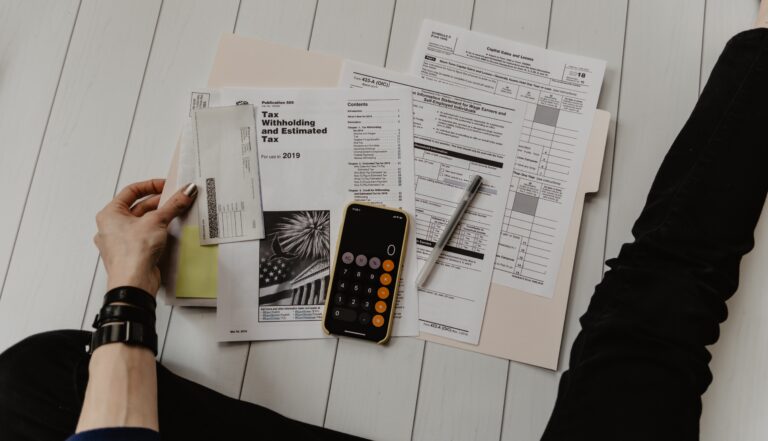

THE BENEFITS OF HIRING A PROFESSIONAL ACCOUNTANT FOR YOUR BUSINESS

– A PERSUASIVE PIECE HIGHLIGHTING THE BENEFITS OF HIRING A PROFESSIONAL ACCOUNTANT, INCLUDING EXPERT ADVICE, REDUCED RISK OF ERRORS, AND TIME SAVINGS. Staying ahead of the competition in today’s fast-paced business environment requires sound financial management and sound judgment. Although…